Foreign investment: Montréal ends 2025 on a good note

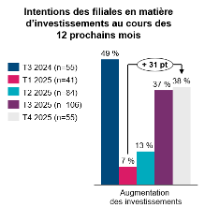

After a rocky start to 2025, foreign investment intentions among Greater Montréal’s international companies have regained momentum to finish strong. According to our latest survey of subsidiaries supported by Montréal International, 40% of respondents plan to invest within the next 12 months, a significant rebound from last February. Following the imposition of customs tariffs, only 7% of respondents has plans to proceed with their investment projects.

How do you explain such a rebound despite a persistent climate of uncertainty? Did we overestimate the impact of the tariffs? Our analyst, Aude Hermenier, shares her insights.

Exporters find new pathways

In the short term, at least, the impact of tariffs was less significant than anticipated. The actual duties paid by Canadian exporters are far lower than those announced by the U.S. administration. According to an RBC analysis, they averaged 6.4% in August —well below the 35% average announced earlier in the year.

Why is that? First, CUSMA already protected a large share of goods traded between the United States and Canada. Second, Canadian exporters’ compliance with the agreement improved significantly: in May 2025, 56% of Canadian goods entering the U.S. were exempt from tariffs. By June 2025, that figure had reached 81%. Forecasters estimate that nearly 90% of Canadian exports to the U.S. could be compliant as early as 2026. In short, CUSMA is more than just an acronym—it’s a strong buffer when the trade road gets bumpy.

Diversification in happening

Despite these CUSMA pathways, Québec exports took a hit in 2025. Their total value dropped from $10.76B in January to $8.49B in August—a 21% decline.

However, there’s light at the end of the tunnel. Québec’s exports outside the United States increased by 6% over the same period. Long‑standing partners such as France, the United Kingdom, and Italy, as well as emerging allies like Poland, Taiwan, and Australia, imported more of our goods.

Québec exporters have clearly embraced diversification. They can rely on 14 free trade agreements (in addition to CUSMA) with 50 countries, providing access to more than 60% of global GDP.

Montréal’s resiliency stands out

Tariffs or not, Greater Montréal’s economic fundamentals work in our favour.

Thanks to top expertise in leading sectors such as artificial intelligence, life sciences, and aerospace, the region stands out in both R&D and manufacturing.

Let’s not forget that Montréal’s economy is more service‑oriented, which has also contributed to its resiliency. Among these services, the city’s tech sector—powered by highly skilled talent—continues to attract foreign investments. The arrival of video game studios iWot and Wizards of the Coast, along with a number of AI companies, illustrates this trend.

Moreover, as investors sought stability at all costs, Canada’s political and financial strength played a key role in maintaining an attractive investment climate. Add to this our competitive operating costs, exceptional quality of life, and vibrant cultural scene, and Montréal continues to stand out as a top destination in North America.

Montréal International also works with more than a hundred private partners, industry clusters, and government stakeholders to inform and support companies in a rapidly evolving geopolitical context.

What will 2026 bring?

Are you a subsidiary? Tell us about your plans for 2026!